By Stephen Paduano, PhD candidate, London School of Economics

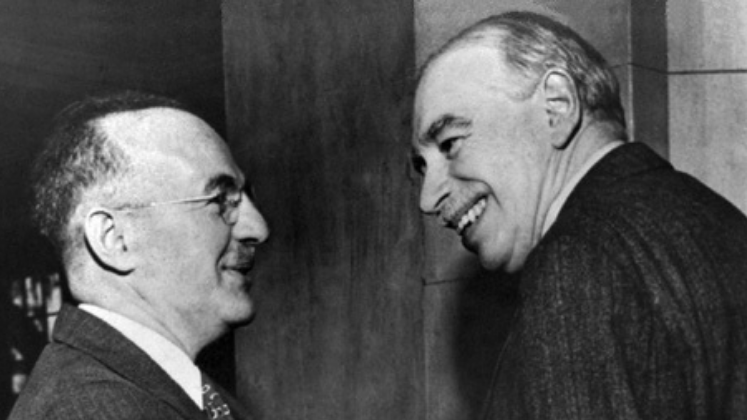

In the long run, economists will be like dentists, according to John Maynard Keynes. This was one of the loftier aspirations of the great economist’s 1930 essay, ‘Economic Possibilities for our Grandchildren’. Surveying the recent wonders of technological innovation and the ‘power of compound interest’, Keynes proposed that in 100 years the living standard would have improved eight-fold, the working week would have collapsed to just fifteen hours and the ‘love of money’ would be revealed as a ‘disgusting morbidity […] semicriminal, semipathological’. Under these conditions, economics would be akin to dentistry, he claimed, an apolitical field whose ‘humble, competent’ practitioners would do little more than set the odd problem straight. Needless to say, in order to arrive at this ‘destination of economic bliss’, one must listen to Keynes.

There is little denial that the world has lent Keynes its ear, and there is little debate that some of his economic policies have been broadly accepted. Generations of economists have organised themselves around and in response to his work. Central bankers and policymakers continue to turn to Keynes when recession looms. With US President Richard Nixon having declared that ‘We are all Keynesians now’, and US Vice President Dick Cheney allegedly agreeing that ‘Deficits don’t matter’, it would seem that even the most recalcitrant conservatives — Keynes’s lifelong opponents — have been converted.

But the bliss that Keynes envisioned has not yet arrived. Why?

In The Price of Peace: Money, Democracy, and the Life of John Maynard Keynes, Zachary D. Carter argues that much to the detriment of the economics discipline and the world, Keynesian economics has been stripped of Keynesian thought.

The story of how this has happened is a riveting and maddening tale about textbook selection, tenure appointments, financial browbeating, presidential politics, elite conspiracies and more. All in all, it would take not only the death of Keynes but also the actions of McCarthyists in Washington, investment bankers in New York, craven university administrators across the United States and a proto-Koch Brothers furniture magnate named Harold Luhnow in Missouri to silence Keynes’s students and suppress his philosophy.

But to understand Keynes’s thoughts and vision, the philosophical essence that has been removed from his more formulaic work on macroeconomics, The Price of Peace begins with an enchanting biography of the man himself. It traces Keynes’s intellectual evolution, from his time as a proud imperialist studying at Eton and Cambridge to a peacenik, leftist visionary who debated with the likes of Bertrand Russell (a mentor of his at Cambridge) and Ludwig Wittgenstein (with whom he kept a correspondence about the philosophy of science even as the Austrian-born logician fought on the frontlines of World War One). It follows Keynes’s avant-garde adventures with the ‘Bloomsbury Set’ and his desire to be accepted by this irreverent friendship group of authors and artists, Virginia Woolf among them, who were often dismissive of Keynes’s lifework. To round out the portrait of a man often at odds with his times, the book also shines light on Keynes’s love affairs, his well-catalogued trysts with men, followed by a runaway romance with Lydia Lopokova, the celebrated Russian ballerina, whom he married in 1925 and with whom he was able to make sense of the emerging Soviet Union.

Weaving together a dazzling array of Keynes’s and his acquaintances’ private letters, journalistic works and academic research, Carter demonstrates how Keynes shaped the world that was born in the volatile beginning of the twentieth century, with his outsized contributions to the field of economics, US and UK domestic politics and the international monetary system. Endearingly, Carter goes on to show how the dramatic events of those years reshaped Keynes, making him and his ideas more ambitious, benevolent and radical at every turn.

Although Keynes wanted his discipline to become like dentistry, at its core his economics was a sweeping, far-reaching philosophy. ‘Not so much a school of economic thought as a spirit of radical optimism,’ Carter writes. Keynes hoped to make the world not only fairer and more prosperous, the standard domains of economists on the left, but also more peaceful and more beautiful. To do so, he argued that nations could and should spend their way to such a blissful future. ‘Were the Seven Wonders of the world built by Thrift?’ Keynes asked in A Treatise on Money. ‘I deem it doubtful.’

But then, on Easter Sunday 1946, Keynes died, and his vision, Carter recounts, died too.

The assault on Keynesianism began a year after his death, with the not-famous-enough saga of Elements of Economics. This was the first and most important textbook of Keynesian economics, published by Lorie Tarshis in 1947, which immediately became verboten during the Red Scare, the period of McCarthyist anxieties about Communist infiltration and subversion in the US that ran from the late 1940s through to the late 1950s. Soon Elements of Economics was renounced and discarded by universities throughout the US and replaced by a new (and approved) textbook: Economics by Paul Samuelson. Samuelson’s alternative offered a ‘neoclassical’ compromise between Keynes and his critics, swapping out Keynes’s emphasis on the irrational ‘animal spirits’ of the market with an ultra-rational, profit-maximising model. It would serve as an economics beginner’s manual for decades to come.

With Wall Street bankers and McCarthyist fearmongers chasing Keynesians out of politics and academia, a new generation of market fundamentalists was born. Behind this transnational assault on left economics and the aggressive propagation of more conservative ideas was an unlikely figure: the heir to a furniture fortune in the Midwest, Harold Luhnow, who helped to found the free-marketeer Mont Pelerin Society and financially supported the careers of Friedrich Hayek, Milton Friedman and Ludwig von Mises, among others.

But some good ideas are too good to be discarded. Low interest rates and fiscal stimulus in times of recession, as opposed to Hayek’s competing prescription of starving the market to allow the business cycle (and suffering) to go on unimpeded, happened to be irresistible after the Great Depression of 1929-39. And when such stimulus could take the policy form of ramped-up military expenditures as it did during World War Two, or upper-class tax cuts as it did under US President John F. Kennedy, even warmongers and plutocrats could cosy up to Keynes. Hence Nixon could say, only mildly sardonically, ‘We are all Keynesians now’, having put (unlawful) pressure on Federal Reserve Chairman Arthur Burns to slash the discount rate from 6% to 4.5% between 1970 and 1972 in an attempt to juice the economy and fix the 1972 Presidential election.

Likewise, US President Ronald Reagan would run record deficits, hitting $221 billion in 1986 (482), through a combination of tax cuts and increased military expenditures, not only in service to his political vision but also to revive the economy after the recession of the early 1980s. When the purportedly small-government, balanced-budget Republicans returned to office in 2001, they too revealed themselves to be adherents to a Frankensteinian philosophy of ‘Reactionary Keynesianism’, embracing deficit spending as they cut the top marginal tax rate from 39.6% to 35% and embarked on foreign wars.

‘Keynes’ pleasant daydream was turned into a nightmare of terror,’ warned Joan Robinson, a trusted academic colleague of Keynes at Cambridge and, to my mind, the undeclared heroine of the book. With the Republicans’ spending priorities and war habits, the ‘nightmare of terror’ was indeed becoming clear. But throughout The Price of Peace, what is portrayed as a greater disappointment is how Democrats perverted and abandoned Keynes all the same.

Following Franklin D. Roosevelt’s presidency, when Keynes’s influence made its debut and reached its high-water mark, and after US President Lyndon B. Johnson’s ‘Great Society’, when a valiant if diluted strain of Keynesianism re-entered the scene, Democrats have gradually become not only less ambitious, but also less sure of their intellectual legitimacy, Carter argues. This is not to say there is a shortage of collegiate elitism in the Democratic Party, but rather that the Party’s collegiate elites have abandoned what knowledge Keynes gave them and embraced a garden variety of conservative economic values: belt tightening, budget balancing, private-sector efficiency and, above all, artificial limits on the possibilities of economic policy.

Through to the present, Carter laments, the Democratic Party has had a habit of resisting the insights of philosophically ambitious and academically rigorous economists. Instead, party leaders often turn to those whom Paul Krugman, the Keynesian, Nobel-Prize-winning economist, calls VSPs — ‘Very Serious People’. The Democratic Party’s VSPs are the tough but fair business elites and pundits who just give the facts, which often come in the form of opinions about runaway inflation in the event of government spending, capital flight in the event of new taxes and other legislative excuses for why this or that just won’t work. When former Delaware Senator Ted Kaufman, a confidante of Joe Biden, recently batted down the idea of a sustained COVID-19 stimulus programme by saying, ‘When we get in, the pantry is going to be bare’, he was Very Serious indeed.

At times, Carter plunges the reader into a deep intellectual depression and gives the sense that Keynes was and will be another one of history’s Cassandras—always right but never believed. Why didn’t US Treasury official Harry Dexter White adopt Keynes’s supranational currency, ‘bancor’, at the 1944 Bretton Woods conference? Why didn’t Winston Churchill listen to Keynes before his ruinous decision to reinstate the gold standard in 1925? (For what it’s worth, Churchill would later quip, ‘Everybody said that I was the worst Chancellor of the Exchequer that ever was. And now I’m inclined to agree with them.’) And why oh why didn’t UK Prime Minister David Lloyd George just trust Keynes on dropping German war reparations in 1919, the impossible financial obligations that stoked the flames of German nationalism before World War Two? In the long run Keynes was dead; the arch-conservatives and capitalists killed him off, Carter writes. But in the short run his ideas, no matter how true and good they were, weren’t particularly alive either. What could bring Keynes back today?

Taking a page from Keynes’s ‘radical optimism’, Carter remains hopeful that Keynes, his economic insights and his philosophical ambitions may yet return to the left in the US. ‘In the long run’, Carter concludes, ‘almost anything is possible’. He is not wrong. In recent years, the growing and unflinching US left has shunned the Democratic Party’s VSPs and brought in post-Keynesian thinkers, living and dead, to make sense of the country’s (and the Party’s) problems. But it is early days for this movement, and it would be premature to rejoice in Keynes’s revival. For him to come back, he must be brought back. Fortunately, The Price of Peace, accessible for general readers, academics and VSPs alike, may help hasten Keynes’s return.

Stephen Paduano is a PhD candidate at the London School of Economics and the executive director of the LSE Economic Diplomacy Commission

Note: The views expressed in this article are the author’s, and not the position of Intellectual Dose, or iDose (its online publication). This article is republished from the LSE Review of Books under a Creative Commons license.